June 09

Brookfield Asset Mgmt gearing up for India renewable energy buyout

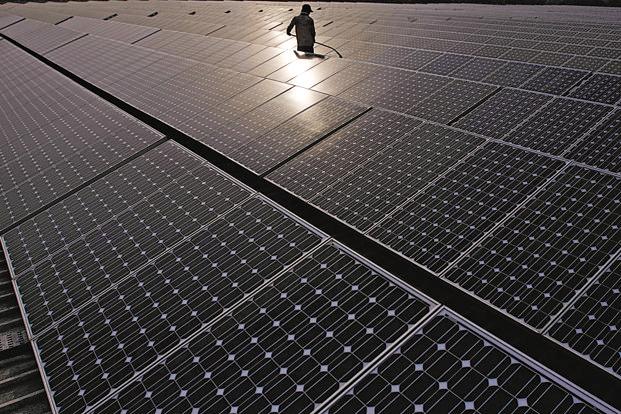

Canada based Brookfield Asset Management which handles $200 bn of diversified assets across the globe is betting big on the Indian renewable energy sector and is preparing for its first major acquisition in the segment. " Brookfield Asset Management is in talks for a 100% buyout of the renewable energy business of Hyderabad -based NSL ( Nuziveedu Seeds Ltd) Group," two individuals familiar with the potential transaction told ET NOW on the condition of anonymity. NSL Renewable Power Private Ltd (NRPPL) is the renewable energy arm of the NSL group and has presence in wind, hydel, bio-mass and solar segments. " Both parties have recently entered into exclusive talks and due diligence is currently being carried out on the deal. There are several marque overseas investors in the renewable energy arm who are keen on an exit via this deal ," added the second source. International Finance Corporation (IFC), Asian Development Bank (ADB), Germany 's DEG ,France's Proparco, South Korea's Asia Clean Energy are amongst NRPPL's overseas investors.

According to data available on the NSL group company website, NRPPL has a total operational capacity of around 337 MW across wind, hydel, biomass and solar segments. Additionally, the company has 767 MW of wind energy under development.